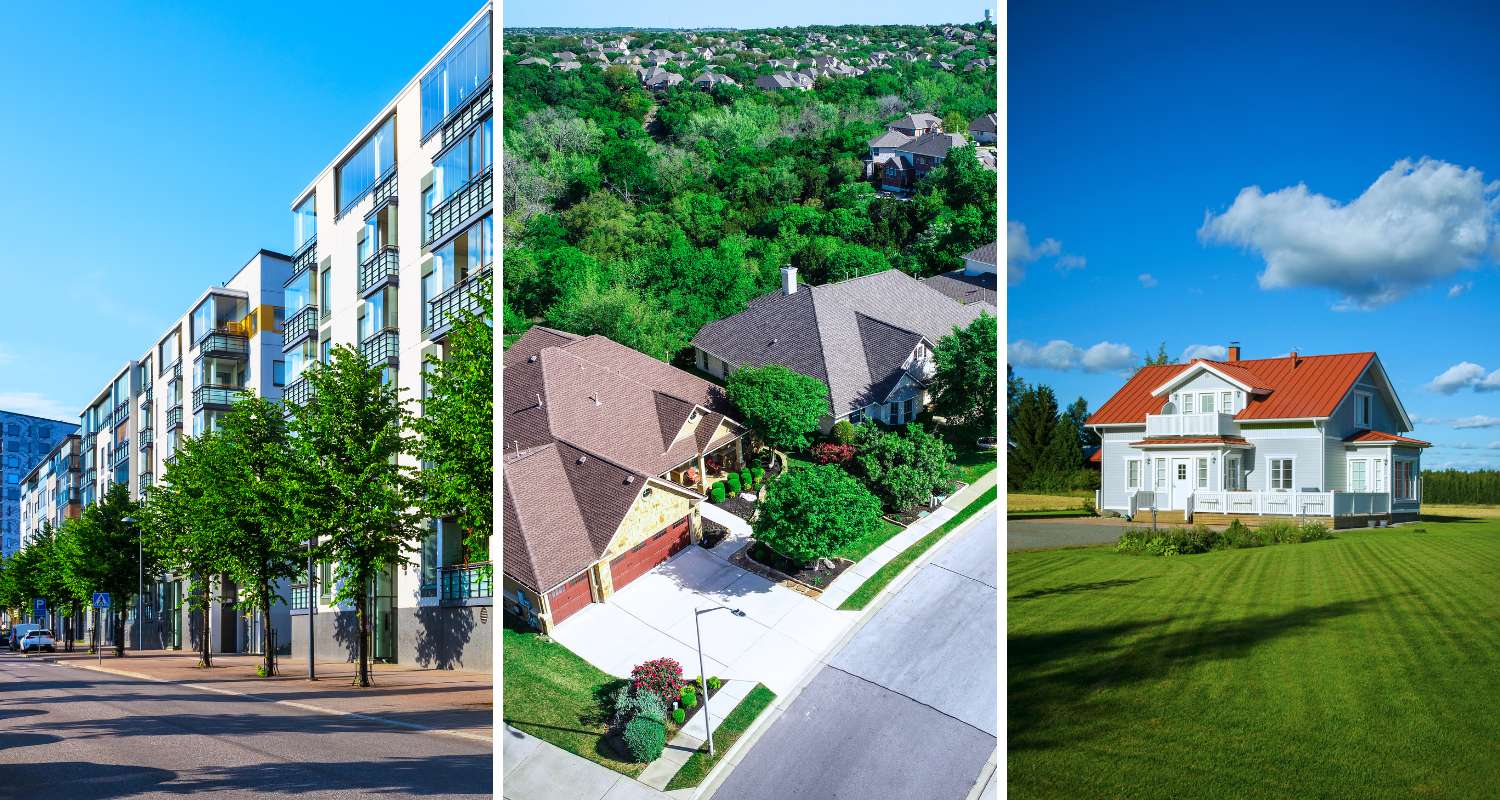

If you’ve ever heard the phrase “Location, Location, Location” in real estate, you know how critical a property’s area and geography are to your overall investment ethos. Where you ultimately choose to invest will establish the expectations for that specific property, and this is going to drive many of the decisions that you make. While there are plenty of ways to categorize various properties, one of the first decisions that you will have to make is whether to invest in an urban, suburban, or rural area.

The importance of location in real estate investing cannot be overstated. It significantly impacts property values, rental demand, and the types of investment property opportunities available. Now, we will explore the distinctions between urban, suburban, and rural real estate, highlighting the advantages and disadvantages of each. Keep in mind that the right location for one person might not necessarily be the right location for someone else. Learn more below, and do not hesitate to reach out to us if you need help financing your next real estate purchase.

Urban areas are typically characterized by high population density and a concentration of businesses, making them vibrant hubs for residential and commercial activities. Urban real estate generally comprises high-rise residential buildings and sprawling commercial spaces centered around financial districts. These areas benefit from well-established infrastructure, including efficient mass transit systems that connect to wider metropolitan regions. There is also a high concentration of job opportunities available, which could drive up the values of property in the area.

Suburban regions, often situated on the outskirts of cities but still otherwise part of the “metro area,” provide a blend of urban and rural characteristics. Lower population densities than urban centers characterize these areas but maintain substantial residential and commercial real estate. Suburban real estate includes large subdivisions of single-family homes, multi-family dwellings, and commercial complexes like strip malls and office parks. There’s also a notable presence of mass transit systems, though less comprehensive than in urban locales. Suburban communities are popular among families, particularly those with children.

Rural areas stand apart due to their expansive open spaces and lower population density per area. Rural real estate is distinctly different, typically involving larger parcels of land and spaced-out residential and commercial properties. These areas are less connected by mass transit and are more likely to include agricultural acreage and smaller, close-knit communities. The real estate market in rural areas tends to have less frequent transactions but offers unique investment opportunities like large-scale farming or eco-tourism ventures. If this is an industry that you understand, it could be an opportunity for you to take advantage of.

Investing in urban real estate comes with a unique set of pros and cons that need careful consideration. Some of the top advantages and disadvantages to keep in mind include:

Larger Demand for Housing: One of the largest draws to urban real estate investment is the unyielding demand for housing due to the proximity to major employment centers and various social amenities. This high demand generally translates to higher rental income and a broad array of investment opportunities, ranging from residential units like apartments and condos to commercial and industrial spaces. Moreover, urban centers often undergo cycles of gentrification, offering a chance to “buy low and sell high,” potentially leading to substantial increases in property values.

Myriad of Investment Options: Diversity in investment options is another significant advantage. Urban settings offer various property types, including luxurious condo-tels, sprawling office spaces, and ground-level retail locations catering to a denser population. This variety allows investors to diversify their portfolios within the same geographic location, mitigating risks associated with market fluctuations.

Potential for Gentrification: The potential for revitalization and upgrading neighborhoods in urban areas cannot be overstated. Investing in areas poised for gentrification can increase property value significantly as neighborhoods transform and attract new socio-demographic groups. This change often brings improved infrastructure, new businesses, and residents, enhancing the overall investment return.

Higher Barriers to Entry: Aside from all the benefits, unfortunately, there are some barriers to entry in urban real estate markets that should be considered. The initial cost of entry is typically higher due to elevated property prices, and ongoing expenses like property taxes and insurance can significantly eat into profits. Additionally, the competitive nature of these markets can drive prices even higher, reducing potential returns.

Increased Competition: Urban investments also have more regulatory oversight, such as stricter zoning laws and building codes, which can complicate renovations and new developments. The aging infrastructure in older buildings presents another challenge, potentially leading to unexpected repairs and maintenance costs.

Regulatory & Infrastructure Considerations: Lastly, the high level of competition in urban real estate markets means that investors need to act swiftly and decisively. The limited availability of land for development can further exacerbate this issue, making it difficult to find lucrative deals without extensive market knowledge and the right connections.

Transitioning from bustling city centers to quieter, more spacious suburbs offers real estate investors a different array of benefits and challenges. A few of the most common advantages and disadvantages to consider include:

Affordability: The affordability of suburban real estate makes it an attractive option for a broader range of investors and homebuyers compared to urban areas. Suburban settings often offer a more family-centric environment, with better access to schools, parks, and recreational facilities, which can drive residential development and attract stable, long-term tenants and ownership.

Family-Centric and Logistical Ease: Furthermore, suburban areas typically offer easier commuter access to major urban centers while providing a quieter, more relaxed living environment. This balance makes suburban real estate appealing to those who work in the city but prefer a less hectic home life. As urban areas become more crowded and expensive, the suburbs have seen predictable price increases and growth, making them a solid investment choice.

The Potential for Growth: Another advantage is the potential for growth as urban sprawl continues. As major cities become overpopulated and property values rise, more people look to the suburbs for more affordable housing options. This shift can lead to steady property value appreciation in suburban areas, although it may occur more gradually compared to urban settings.

Dependence on Urban Centers: One point to consider is the extent to which suburban real estate markets heavily depend on the prosperity of urban centers. Suburbs typically grow and thrive based on their proximity to cities, relying on them for employment, entertainment, and cultural amenities. This dependence can pose risks if the connected urban area faces economic downturns or cyclical changes.

Lack of Robust Public Transit Options: Long commute times and the lack of high volume public transportation can also deter potential residents, particularly in areas with limited public infrastructure and development. Additionally, suburban areas’ zoning restrictions can slow the development of new commercial and residential projects, limiting growth opportunities for development investors.

Slower Development: Lastly, suburban areas are often secondary priorities for municipal funding, affecting the speed and scope of community improvement projects. This can result in slower growth and development than urban settings, potentially impacting investment returns in the short term.

Exploring the farthest reaches from urban centers, rural real estate presents a unique set of investment considerations. Some pros and cons you might want to consider include:

Lower Cost: The most apparent advantage of investing in rural real estate is the lower property acquisition cost. These areas often feature less competition and lower land values, making it easier for investors to enter the market. Additionally, the lower cost of living in these areas can translate into “higher yield per property” for investors, as lower property costs can allow for competitive rental rates while maintaining decent profitability.

Diversity of Investment Options: Rural areas offer diverse investment opportunities not commonly found in urban or suburban settings. These include agricultural ventures, vacation homes, and even niche markets like eco-tourism facilities and cannabis cultivation. The availability of large tracts of land for sale also provides opportunities for significant development and infrastructure improvement projects.

Challenging Economic Situation: However, the economics of investing in rural areas can be challenging. The limited economic diversity and lower population density often result in lower rental demand and aggregate income yields. These factors can lead to longer timelines for selling properties or finding suitable tenants, impacting the liquidity and overall return on investment.

Municipal and Recreational Issues: Rural areas typically see lower investment returns due to these factors, making them less attractive to institutional lenders and investors. This can lead to less favorable financing options and higher interest rates for investing in these areas. Development projects in rural areas can also face longer timelines for approval and funding, further complicating investment strategies.

When it comes to real estate investing, there is no one-size-fits-all answer. Each type of area—urban, suburban, and rural—offers unique advantages as well as challenges. As an investor, the key is diversifying your portfolio across different types of markets. This strategy can help protect against any market downturns and maximize potential returns across your investments. It is also important to have the right financial backing for whatever investment opportunity you pursue. That means you need to partner with the right team, and our experts are available to help you.

Understanding the nuances of urban, suburban, and rural real estate markets is essential for making informed investment decisions. Tailoring your strategies to your investment goals, risk tolerance, and personal preferences can lead to successful outcomes. At EquityMax, we are dedicated to providing personalized guidance and support to navigate the complexities of real estate investing. Our team of experts is here to help you every step of the way, ensuring that you have the resources and knowledge needed to succeed.

EquityMax offers a broad and competitive scope of financing options for real estate investors. Whether you are looking to invest in a bustling big city or a tranquil rural area, whether you need a large loan or just $15,000, EquityMax can fund it. We invite you to prequalify today, apply for a loan, and explore our comprehensive loan programs to find the best options for your real estate investments. Contact us today to speak to our team, and let’s get started.